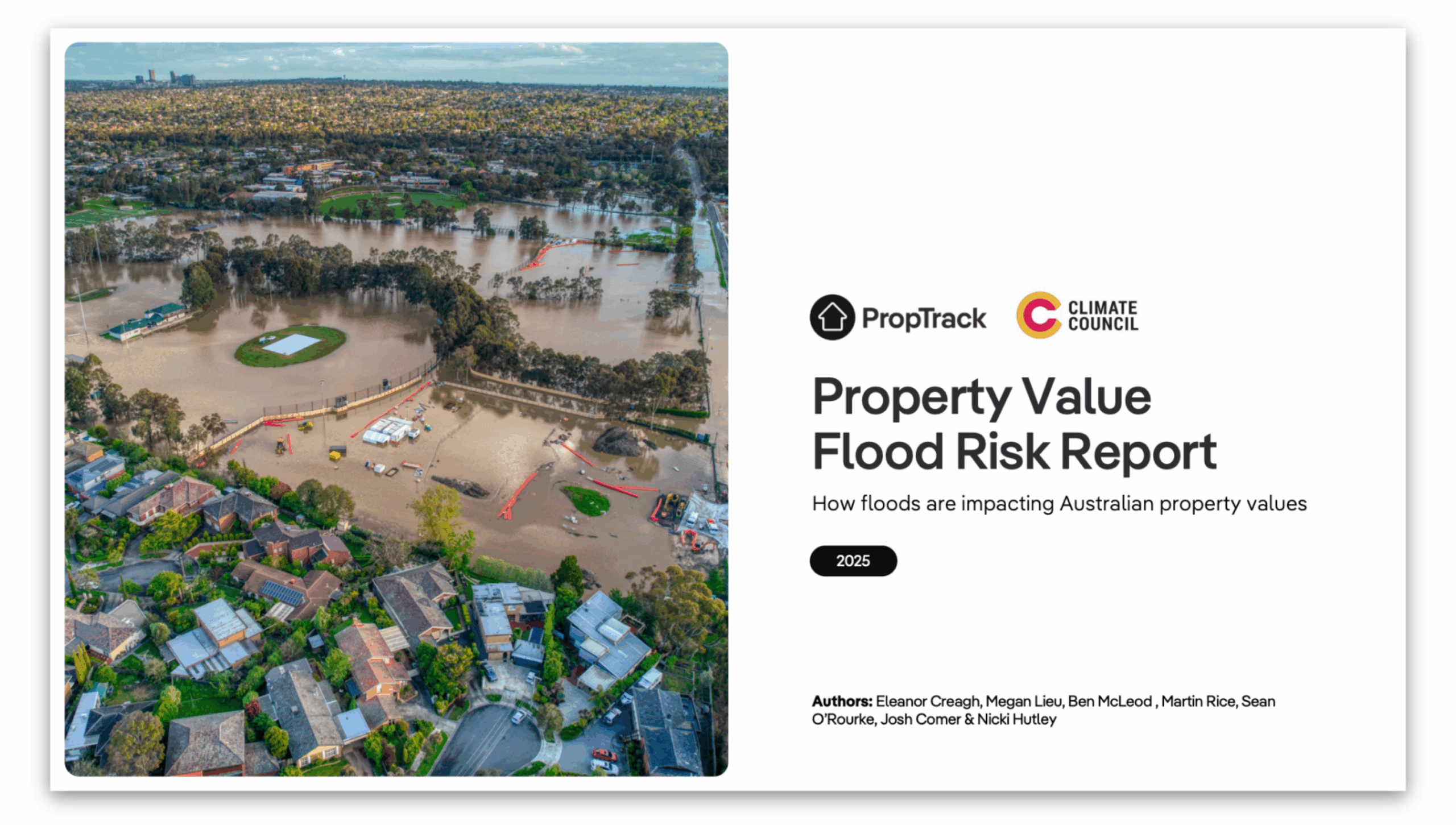

Climate pollution is endangering our homes, and risking the biggest asset of many Australians, with new analysis revealing flood risk has put a $42.2 billion dent in property values.

This is an Australian-first report that analyses more than 20 years of historical property data alongside flood risk. It finds that today, flood-prone homes in Australia are worth $42.2 billion less than they could have been without the risk of flood.

Climate pollution from coal, oil and gas now blankets the world, trapping heat. This heat means more evaporation and an atmosphere that holds more moisture. As a result, flood risk has grown in Australia.

Climate Council partnered with PropTrack, Australia’s leading source of property insights, to analyse what this flood risk means for the individual and collective value of our properties. We found flood risk has cost Australians $42.2 billion overall, with one in six homes at risk of flooding today.

The bulk of these properties are in Queensland, where flood risk has cost homeowners $19 billion as at April, 2025. The Gold Coast ranks highest within the state, with a collective $4.5 billion in value foregone across the region. NSW follows closely behind, with more than $14 billion foregone in flood-related value.

Overall rising property prices are masking the fact that flood-prone homes are starting from a lower base and rising at a slower pace. Nationally, since 2000, the price growth gap between flood-prone homes in Australia – and those without such risks – has reached 22 percentage points. For a typical three-bedroom, two-bathroom house that equates to being valued $75,500 less. As climate-driven floods become more frequent and severe, more properties could face steeper penalties.

Concerted action in Australia and around the world to cut climate pollution from coal, oil and gas can limit how many more homes are put at risk in the future. The insurance and banking industries are already embedding those climate risks into their business decisions. However, to date, there has been limited detail available to individual homeowners on what the risk to their greatest asset already is, as well as how that might worsen over time. Every Australian deserves to understand the climate risk that their home is already facing, as well as how those risks might increase.

No matter where we live, all Australians are paying a heavy price due to climate change. That might be because our own home is at direct risk of worsening extreme weather – like floods – or through rising insurance premiums and recovery costs.

We have a choice about how much worse we allow this to get – and therefore, how many more Australian homes are put at risk, or lost. This is why the Australian Government must stop making this problem worse by continuing to approve new coal and gas projects by overhauling our environment laws so they are fit for purpose. Because every tonne of climate pollution is doing us damage.

Key Findings

This report presents the first national-scale evidence of the property market’s response to increasing flood risks, combining historic hazard data from the Geoscape Planning and Insights dataset with PropTrack’s real estate data.

Flood risk has cost Australians $42.2 billion, with 1 in six Australian homes at risk of flooding

- In Australia there are just over two million flood-prone homes. Of those, at least 70% experienced a reduction in value due to flood risk.

- In regions where flood risk reduces values:

- Homes exposed to flood risk are collectively worth $42.2 billion less than they would be in the absence of flood risk.

- A disproportionate share of this foregone value is borne by only a few regions; reflecting the geographic concentration of risk.

- As of April 2025, the median value of a *typical home at risk of flooding is valued $75,500 lower than a typical home without flood risks.

- While prices of flood-prone homes rise over time, they often do so from a lower base and at a slower pace.

- Nationally, since 2000, the price growth gap between flood-prone and flood-free homes in Australia has reached 22 percentage points.

Queensland and New South Wales homeowners face the largest flood impacts on property value

- The bulk of properties at risk of floods are in Queensland (40%) and New South Wales (30%).

- In Queensland, the total dollar value foregone due to flood risk exceeded $19 billion as at April 2025. The Gold Coast ranks highest within the state with a collective $4.5 billion in value foregone across the region.

- NSW follows closely behind, with flood-related value of more than $14 billion foregone.

- Even high-value areas and prestigious innercity or coastal communities can see losses of more than $500,000 per home compared to nearby and comparable flood-free properties.

- Known for its prestige beachfront properties, flood-prone houses in QLD’s Mermaid Beach – Broadbeach experience a 48% reduction in value due to flood risk, despite just 16% of houses being in flood zones, reflecting a market highly sensitive to risk perception.

- Houses in NSW’s Bellevue Hill and Balmain show large average dollar value losses per flood-affected house.

Market behaviour and perceived vulnerability drive price outcomes

- In some regions, the risk of flooding is outweighed by features like coastal views and beachside lifestyle. For example, houses in flood zones within the Sunshine Coast’s Noosaville and Noosa Heads, Brisbane’s Cleveland, and Gold Coast’s Hope Island are typically valued higher than comparable risk-free homes.

- In regions where flood risk reduces values, price impacts appear to be shaped by perceived vulnerability with recent events having a higher impact on price than the share of homes exposed to flood risk.

- In some suburbs with a lower share of floodprone properties, property level flood penalties are much larger than suburbs with a higher share of properties that are floodprone. This may reflect the impact of recent disaster memory, insurance challenges or property-level vulnerability.

*Typical home, three-bedroom, two-bathroom house